Annual Meeting, April 24

Dale Kovar, New President/CEO

We are excited to welcome Dale Kovar as our new President/CEO. Dale transitioned into this role on January 1, from his prior position as Executive Vice President. Dale has been with FNCU since 2016.

To read the full press release, view our October newsletter.

What are some classic warning signs of possible fraud and scams?

Scammers are getting better all the time, so brush up on the tricks they use, so you can protect yourself.

Criminals and con artists use many scams to target people of all ages. Consumer scams happen on the phone, through the mail, e-mail, or over the internet. They can occur in person, at home, or at a business.

Warning signs, from someone:

- Claiming to be from the government, a bank, a business, or a family member, and asking you to pay money.

- Asking you to pay money or taxes upfront to receive a prize or a gift.

- Asking you to wire them money, send cryptocurrency, send money by courier, send money over a payment app, or put money on a prepaid card or gift card and send it to them or give them the numbers on the card.

- Asking for access to your money – such as your ATM cards, bank accounts, credit cards, cryptocurrency wallet keys or access codes, or investment accounts.

- Pressuring you to “act now” or else the deal will go away, or trying hard to give you a “great deal” without time to answer your questions.

- Creating a sense of urgency or emergency to play on your emotions.

In the end, they will be asking you for money, or personal information to get access to your money or identity. Once they have that information, they can drain your bank account, or steal your identity to gain access to your accounts.

Tips to protect yourself from scams:

- Don’t share numbers or passwords for accounts, credit cards, or Social Security.

- Never pay up front for a promised prize. It’s a scam if you are told that you must pay fees or taxes to receive a prize or other financial windfall.

- After hearing a sales pitch, take time to compare prices. Ask for information in writing and read it carefully.

- Too good to be true? Ask yourself why someone is trying so hard to give you a “great deal.” If it sounds too good to be true, it probably is.

- Watch out for deals that are only “good today” and that pressure you to act quickly. Walk away from high-pressure sales tactics that don’t allow you time to read a contract or get legal advice before signing. Also, don’t fall for the sales pitch that says you need to pay immediately, for example by wiring the money, sending it by courier or over a payment app, or by sending cryptocurrency.

- Beware when someone plays on your emotions or claims there’s an urgent situation. Advances in artificial intelligence make it easier for scammers to clone voices and alter images to make it seem like someone you know needs help. Contact the person yourself to verify the story. Use contact information you know is theirs. If you can’t reach them, try to get in touch with them through another trusted person, like a family member or their friends.

- Don’t click on links or scan QR codes. These can take you to scammers’ malicious websites or give them access to your device.

- Put your number on the National Do Not Call Registry. Go to www.donotcall.gov or call (888) 382-1222.

Our top checking accounts* include Identity Theft Solutions, which can help you detect and recover from identity theft, at no extra cost to you! Coverage includes family members. We include this valuable benefit as part of your checking account, because we want to help protect you.

* Secure, Premier, and Select checking accounts include Identity Theft Solutions; Classic checking does not. For more information, visit firstnebraska.org/identity-theft-solutions.

The Great SEG Giveaway!

Once again, we gave away $2,000 to our Select Employee Group employees in October! Here are the 10 $200 gift card winners:

General Dynamics – Ashley G.

Teledyne – Savanna C.

White Castle – Mickaela A.

Tri-Con – Alice H.

Rotellas – Oliver L.

LBT – Travis D.

Judds Bros- Lukas L.

Douglas County – Jesus R.

Conductix – Scott J.

Bison – Chris L.

Supporting our SEGs

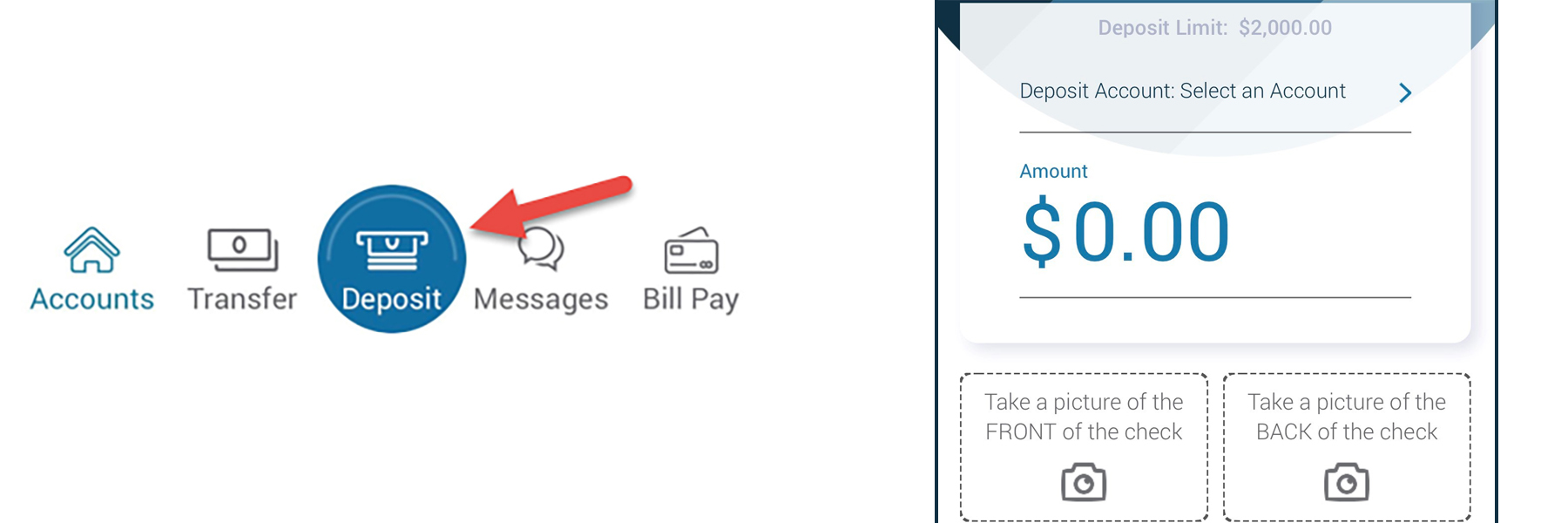

Deposit Checks from home!

Take a picture of your check within the mobile app:

It’s quick and easy!

- Take a photo of the front and back of the endorsed check.

- Click “Submit.”

- You will receive a notification once items are accepted for deposit and processed to your account.

Watch a video and get more tips!

See how it’s done – click here!

Children’s Miracle Network

Raising money for Children’s Nebraska

We teamed up with Credit Unions for Kids to raise money for Children’s Miracle Network, and that money goes directly to Children’s Nebraska hospital in Omaha.

In November, members were able to request a personalized letter from Santa, for $3 each, to be sent to the special children in their lives.

In December, we sold gingerbread ornaments for $5 each, and all proceeds will go to Children’s Nebraska.

Plus, year-round, when you get candy from the branch candy machines, 100% of that money goes to Children’s Nebraska!

About Credit Unions for Kids (CU4Kids): It’s a cooperative network of credit unions that support nonprofit children’s hospitals in the U.S. In 2023, they raised over $17 million for Children’s Miracle Network Hospitals.

Diaper Drive Donations

In December, we donated 785 diapers plus wipes and $200 to the Lydia House in Omaha in December.

Thanks to all who donated!

Employee Recognition

Promotions

(Nov 2024) Nicco Young, promoted to Branch Manager

(Jan 2025) Dale Kovar, promoted to President/CEO

Anniversaries

(Nov 2024) 10-year Anniversary: Cheryl Hamre, Erin Kershner and Tae Volberding

(Oct 2024) 10-year Anniversary: Adriana Cain

What our members are saying

“I truly appreciated Austin’s assistance with our CDs. He explained things to my wife and me clearly and even sent me the necessary documents for my e-signatures so that I did not have to drive up to Lincoln for it. The rest of the tellers are friendly and helpful at this Yankee Hill area location in Lincoln.”

– Marvin C.

Closed for the Holidays

Martin Luther King, Jr. Day

Monday, Jan. 20

Presidents Day

Monday, Feb. 17