New Year, Strong Rates

Annual Meeting in April

All Members are invited to our Annual Meeting, which will be held Thursday, April 23, 2026 at the Omaha Marriott (10220 Regency Circle, Omaha, NE). Doors open at 5 p.m. Dinner and dessert bar will be served from 5-6 p.m. The business meeting will start at 5:35 p.m.

The Board of Directors is comprised of volunteers who represent the entire membership.

RESERVE THE DATE!

Call (402) 492-9100 to make your reservation.

Do This, Not That – Plan Your 2026 Finances with Ease

According to a recent WalletHub survey1, nearly 3 in 4 people say their financial situation impacts their mental well-being, and 69% of Americans feel insecure about their finances. It is no wonder so many of us are tired of traditional “new year, new budget” advice.

Financial wellness does not have to mean strict spreadsheets. It is about taking small, actionable steps to feel more in control.

Do This: Review your spending patterns

Not That: Start with a strict budget

Take a week to observe how you actually spend. Look at your bank statements and credit card bills to spot patterns. Are subscriptions you no longer use still draining your account? Are grocery runs adding up to more than you realize?

When you understand where your money is really going, you can make small, realistic adjustments – like shopping for generic brands or switching streaming services seasonally. Real progress beats rigid plans every time.

Do This: Automate what you can

Not That: Rely on willpower to save

If you have ever meant to transfer money into savings but forgot (again), automation can save you from yourself. Schedule automatic transfers to savings on payday, set up direct deposit to savings, or set up autopay for bills to avoid late fees.

This trick works because it removes temptation and decision fatigue – two major barriers to saving consistently. Even a small automatic transfer adds up over time. Think of it as paying your future self-first.

Do This: Build an emergency cushion

Not That: Wait until you can save “enough”

A full emergency fund (three to six months of expenses) sounds great on paper and can feel impossible when money is tight. Start smaller. Even $20 a week builds momentum. Keep it in an easy-access account, separate from other money, so it does not get mixed with daily spending.

This cushion helps protect you from unexpected costs – a car repair, a surprise bill, or even a missed paycheck – and gives you confidence that you can handle what comes your way.

Do This: Plan for joy – not just bills

Not That: Treat fun as “extra” or “unnecessary”

Your budget should not just be about survival. Planning ahead for things that bring you joy, like a family outing, a weekend getaway, or even a nice meal out, keeps your financial plan sustainable. When you budget for joy and happiness, you are less likely to fall into guilt spending or burnout later.

Do This: Check your credit and debt picture

Not That: Avoid it because it feels stressful

It is tempting to look away from debt; however, facing it head-on is the first step to taking control. Pull your free credit report at AnnualCreditReport.com and review all your balances, interest rates, and due dates.

Focus on paying off the smallest balance first (the “snowball” method) to build momentum or tackle the highest-interest debt first (the “avalanche” method) to save money over time.

Do This: Seek trusted support

Not That: Navigate your finances alone

You do not have to have every answer to feel financially confident. Your financial institution offers budgeting tools, workshops, or savings programs to help you get started.

If you are dealing with debt, GreenPath offers free financial counseling and a proven Debt Management Program designed to lower interest rates, reduce payments, and reduce your stress in the coming year.

This article is shared by our partners at GreenPath Financial Wellness, a trusted national non-profit.

Take the first step: Call 877-337-3399

1. wallethub.com/blog/financial-insecurity-survey/139480

Donations for Children’s Nebraska

In 2025, we teamed up with Credit Union for Kids to raise money for Children’s Miracle Network, and that money goes directly to Children’s Nebraska hospital in Omaha. We are happy to announce that the total amount given was $5,706.79.

Thanks to the help from the Nebraska Credit Union League, members were able to request personalized letters from Santa, which were sent to the children.

In December, our staff did a 50/50 raffle, and the winner gave all of his winnings back to the cause!

We held a shred event, sold tote bags and gingerbread ornaments, with proceeds going to Children’s Nebraska.

Plus, year-round, 100% of the money from the Branch candy machines, and $4 from every Savvy Merch item ordered goes to Children’s.

About Credit Union for Kids (CU4Kids): It’s a cooperative network of credit unions that support nonprofit children’s hospitals in the U.S. In 2023, they raised over $17 million for Children’s Miracle Network Hospitals. To learn more, visit cu4kids.org.

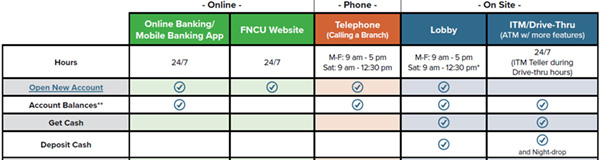

Accessing Your Money

FNCU has many ways for you to get your money without having to visit a Branch. Here are some ways to do some of the most popular transactions:

- Transferring funds:

- Transfer funds between FNCU accounts: On Online Banking/Mobile app, use the “Transfer” button, or give us a call.

- Transfer funds from FNCU to a non-FNCU account: Use Bill Pay on our Online Banking/Mobile app.

- Transfer funds from a non-FNCU account to an FNCU account: Use the “Make a Payment” button on our website, or on Online Banking/Mobile app.

Depositing a Check:

- On the Mobile app, use the “Deposit” button, and take a picture of your check.

- Use the ATM/ITM or the Night Drop box at any Branch.

Banking when traveling or if an FNCU Branch is not close to you:

Use Shared Branching locations across the U.S., and around the world. There are 5,600 Credit Unions that participates in CO-OP Shared Branching, and can do basic transactions for you. To find a location, visit firstnebraska.org/shared-branching

Check your Credit

New Year’s Reminder!

Get a free credit report at annualcreditreport.com. This is the only official site explicitly directed by Federal law to provide them.

It’s quick and easy to check all three credit report companies at annualcreditreport.com! And, if you find inaccurate information, you can start a dispute.

Checking Perks = Credit Score

Members with Premier, Secure, and Select Checking Accounts can access your credit score for free!

Checking Perks includes identity theft resolution services, credit monitoring, credit file monitoring AND your credit score. To learn more, visit firstnebraska.org/checking-perks.

Your credit report can help detect identity theft. Review your report for suspicious activity or accounts you don’t recognize.

Saturday Hours

Our Lobbies are open on alternating Saturdays of each month:

- Bedford – Open 1st and 3rd Saturdays.

- 48th St – Open 2nd and 4th Saturdays.

- Elkhorn – Open 2nd and 4th Saturdays.

- Yankee Hill – Open 2nd and 4th Saturdays.

- Lincoln North – Open 1st and 3rd Saturdays.

- (All lobbies closed on the 5th Saturday.)

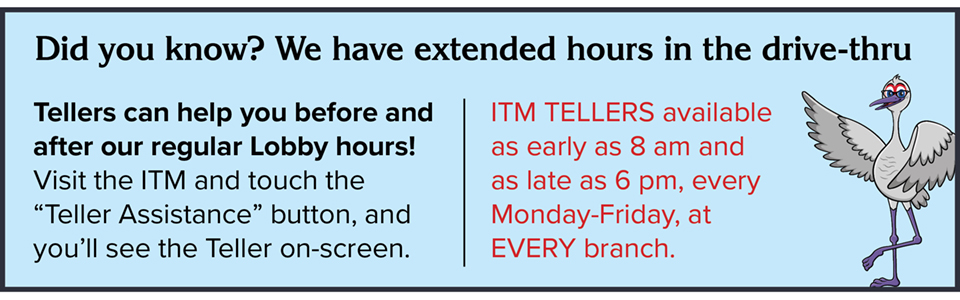

For all Lobby hours and our ITM Drive-thru hours, please visit firstnebraska.org/contact-locations

The Great SEG Giveaway!

Once again, we gave away $1,500 to our Select Employee Group employees in October! Here are the ten $150 gift card winners:

Conductix – Kyle C

Conductix – John M

Judds Bros Construction – Jeff S

Omaha Housing Authority – Julie B

Omaha Housing Authority – Loretta S (pictured)

Rotella’s – Elmer F

Rotella’s – Armondo M

Sarpy County – Leonard P (pictured)

Southeast NE Community Action – Jenny S

Tri-Con Industries – Sarah S (pictured)

Project Santa

Thanks to everyone who donated toys to Project Santa! We were proud to be the drop-off site for this donation drive, brought to you by KFAB, KGOR, the Open Door Mission and Lydia House.

What our members are saying

“FNCU is great to work with, and I appreciate their being there to help with financial needs. The staff is great—caring and friendly. The process is seamless and is done in a timely fashion. The best interest rate was provided to me by FNCU, over other financial institutions, too. Thank you, FNCU!”

—Deborah S.

Closed for the Holidays

Martin Luther King, Jr. Day

Monday, Jan. 19

Washington’s Birthday (Presidents Day)

Monday, Feb. 16