People Helping People is our quarterly newsletter focusing on financial topics and news that is most important to our members.

Annual Meeting

Money Mindfulness: Practicing Financial Self-Care

The prevalence of self-care messaging reminds us to nurture our physical and mental well-being—with mindfulness practices, exercise routines, and virtual detoxing. But what about financial self-care?

When we cultivate positive money habits and plan for our future we are (quite literally) investing in ourselves. Financial self-care is rooted in self-awareness, discipline, and intentionality. Here are several ways you can practice financial self-care, starting now.

Build a Budget

Building a budget is akin to giving yourself the gift of clarity: it allows you to track expenses, identify potential areas where you can trim spending, and allocate funds to help you achieve financial goals. Rather than seeing budgeting as a restrictive practice, frame it as a tool that grants you freedom to spend where it matters. Connect with your financial institution to see what budgeting tools they offer and check out this interactive budgeting worksheet in the meantime.

Create an Emergency Fund

More than half of Americans fear they wouldn’t be able to cover daily living expenses for a month if they lost their income tomorrow, according to a recent Bankrate survey. Invest in your future peace of mind: set up an automatic, recurring savings deposit with the goal of setting three to six months’ worth of living expenses aside. If you’re living paycheck to paycheck, you can start small by setting aside 2% of your net income and gradually increasing your contribution rate when possible.

Tackle Debt

With recent federal interest rate hikes, borrowing costs have reached historic highs which means even your debt is costing you more money. If you’re feeling overwhelmed, you’re not alone. Taking proactive steps towards debt reduction can improve your financial health and significantly reduce your stress. Unsure where to begin? Explore a Debt Management Program, designed to pay off your debt in 3-5 years and deepen your financial resilience.

Plan for Retirement

If your employer offers a 401(k)-retirement plan, take advantage of this benefit (especially if your company matches part or all of your contribution). Don’t have a workplace retirement account? You can still open a Roth IRA—a tax-advantaged retirement savings account. If you find it challenging to save throughout the year, consider setting aside part or all of your tax refund as a way to begin investing without impacting your day-to-day budget.

Get Educated

One of the most empowering aspects of financial self-care is education. Chat with your financial institution about what resources they offer. If you want to explore courses and are worried about costs, take advantage of free financial education online. Whether you’re preparing to buy a home or navigating your auto loan, these sessions offer jargon-free, shame-free guidance to help you reach your financial goals.

This article is shared by our partners at GreenPath Financial Wellness, a trusted national non-profit.

Select Employee Groups

Did you Know?

Identity Theft Solutions is included in our top checking accounts! It covers all identity fraud, not just your FNCU accounts. Learn more.

Check your credit

New Year’s Reminder!

Get a free credit report at annualcreditreport.com. This is the only official site explicitly directed by Federal law to provide them.

Your credit report can help detect identity theft. Review your report for suspicious activity or accounts you don’t recognize.

It’s quick and easy to check all three credit report companies at annualcreditreport.com! And, if you find inaccurate information, you can start a dispute.

Congratulations to our staff members with anniversaries

Happy 5-year Anniversary, Cole Race!

Nov. 2023 – Cole started as a part time teller and moved into a financial service specialist role before his current position, which is Consumer Lending Coordinator.

He said he works so he can afford to buy toys for his dog. 😊

‘Twas the Season to Give!

- Santa Letters & Visit

- Christmas gifts for Community Action Program

- Diaper Drive

In December, we hosted a Santa visit at our Yankee Hill branch in Lincoln, co-sponsored by our Select Employee Group, White Castle Roofing. We also accepted letters to Santa. Each letter was answered and mailed back to the child.

We donated children’s toys plus $555 to Community Action Partnership of Lancaster and Saunders Counties. These toys will be available to families in the program to choose from, to provide gifts for their children.

We also donated 780 diapers plus wipes and $400 to the Lydia House in Omaha in December.

Thanks to all who donated!

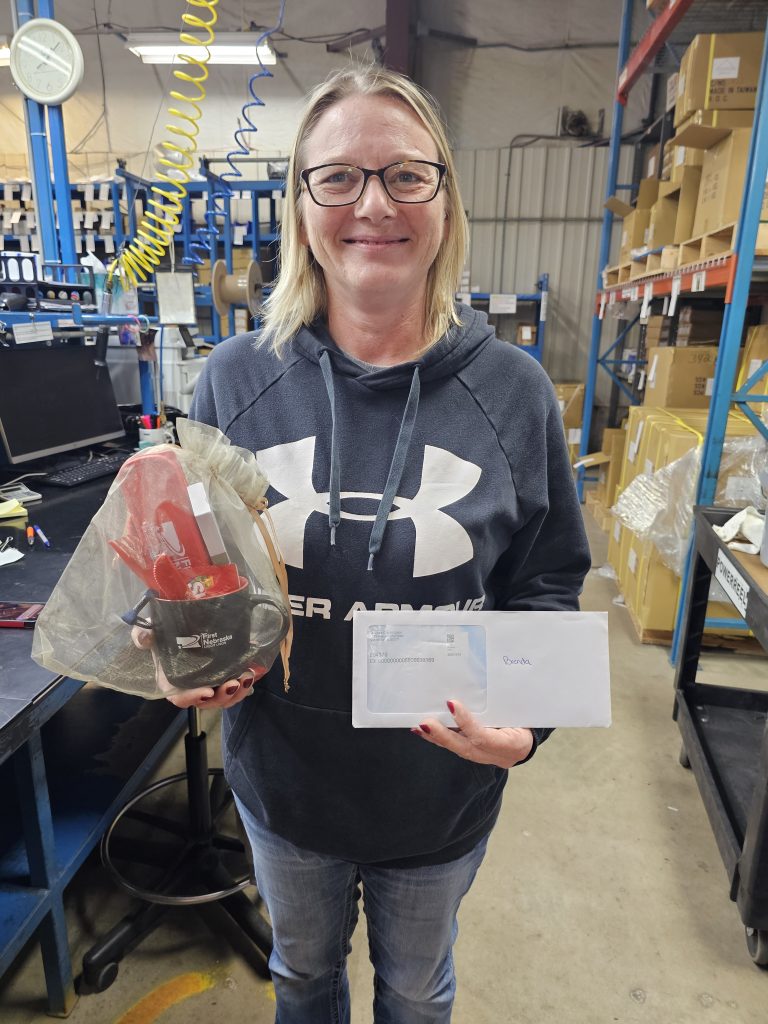

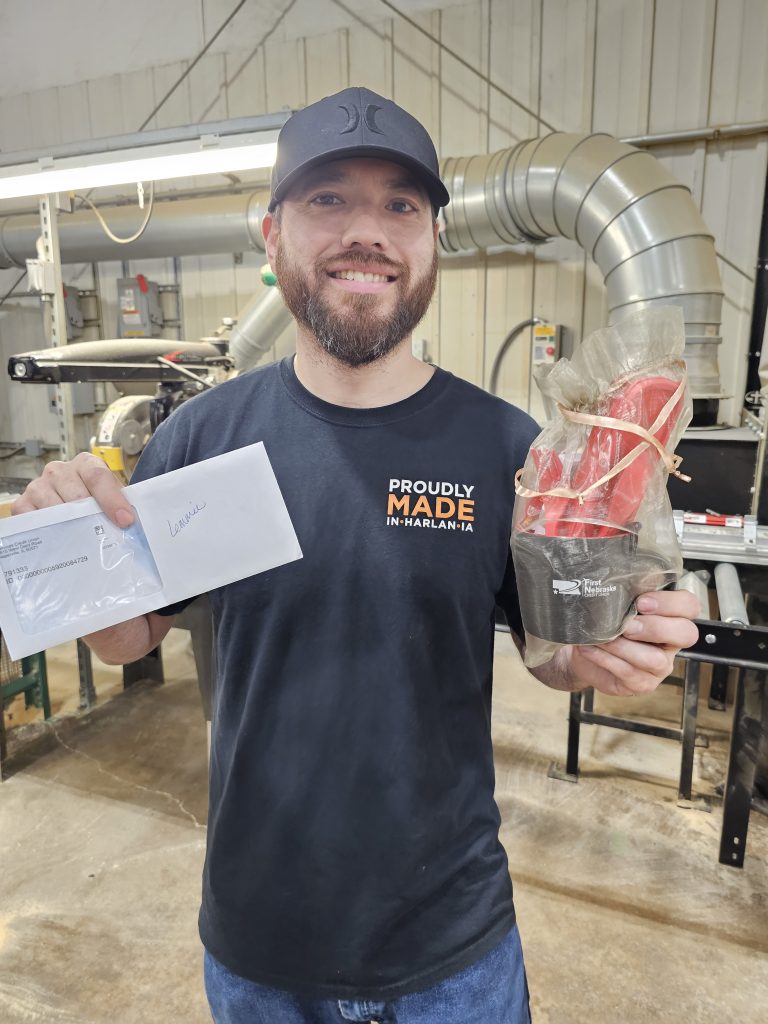

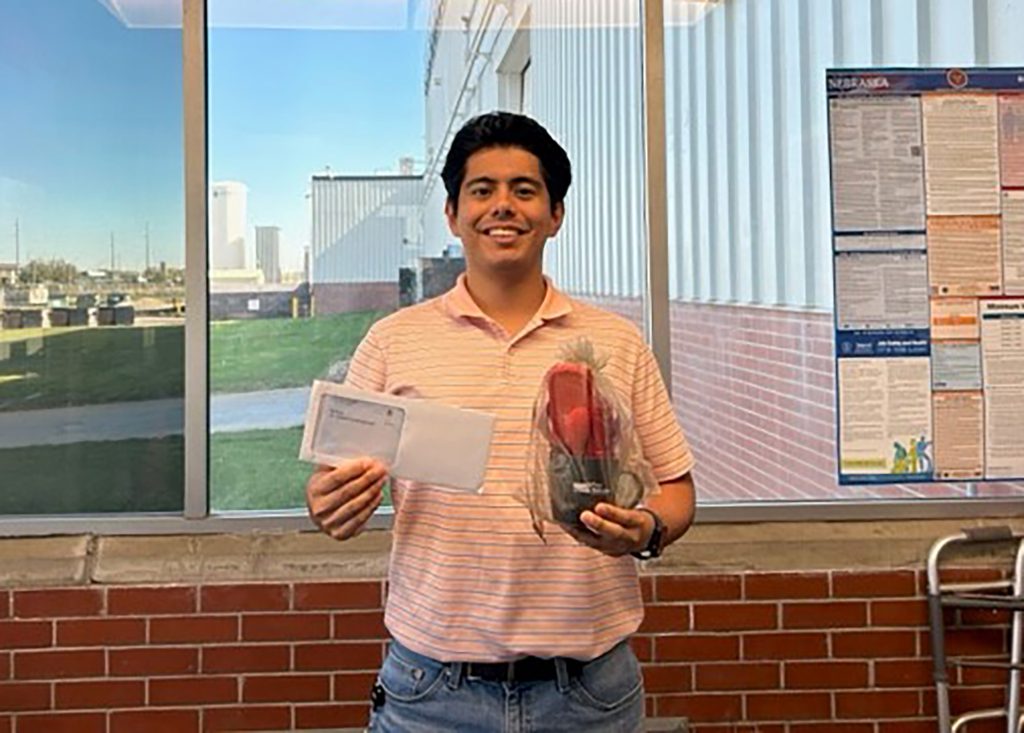

The Great SEG Giveaway Winners

To help celebrate International Credit Union Day in October, we gave away $2,500 to our Select Employee Group employees! Here are the 10 $200 gift card winners:

1 – Brenda R – Conductix-Wampfler

2 – Denice V – Stephens & Smith Construction

3 – Tyrell H – Teledyne ISCO, Inc.

4 – Greg S – TriCon Industries

5 – Katie L – Blue Valley Community Action

6 – John C – Omaha Housing Authority

7 – Patrick R – White Castle Roofing

8 – Lemuel S – Conductix-Wampfler

9 – Tammy H – LBT

10 – Johnathan I – General Dynamics

What our members are saying

“Not just Professional service, but Personal service. The staff if thorough, attentive & friendly.”

Tracy S.

Closed for the Holidays

Martin Luther King, Jr. Day

Monday, Jan. 15

Presidents Day

Monday, Feb. 19