Having trouble logging into Online Banking or the Mobile App?

1. Make sure you’re using the most current version

ONLINE BANKING: The most current version: 2.27.4.4 (located on the bottom left of the login screen). If you are using a previous version, refresh your browser by clicking F5 on your keyboard (or Command-R on Mac).

MOBILE APP: The most current version of our Apple Mobile Banking app is 2.20.0, and Android Mobile Banking app is 2.27.1 (located at the top, above the User ID/Password box). If you are using an older version, please get the update from your App Store/Google Play.

2. Clear your history:

If your login credentials aren’t working (but you’ve successfully logged into online banking before), try clearing the history (i.e., cache) on your internet browser. Click on the link for instructions on clearing your history:

- Click here to learn how to clear your cache in Google Chrome.

- Click here to learn how to clear your cache in Chrome on an Android phone.

- Click here to learn how to clear your cache in Firefox.

- Click here to learn how to clear your cache in Safari.

If you are still have problems with Online/Mobile Banking, please give us a call at (402) 492-9100.

If you haven’t enrolled yet, take a look at the tips below.

Enrolling for the first time

First time users checklist:

- Enroll in Online Banking.

- Download the FNCU Mobile app. (Online Banking and the Mobile app use the same login credentials, so you only need to “enroll” in one of them).

- Enroll in eStatements (within Online Banking).

- Enroll in Bill Pay (within Online Banking).

- Establish eAlerts (within Online Banking).

- Enroll in Phone Banking by calling (531) 600-6797. (Save this number in your contacts.)

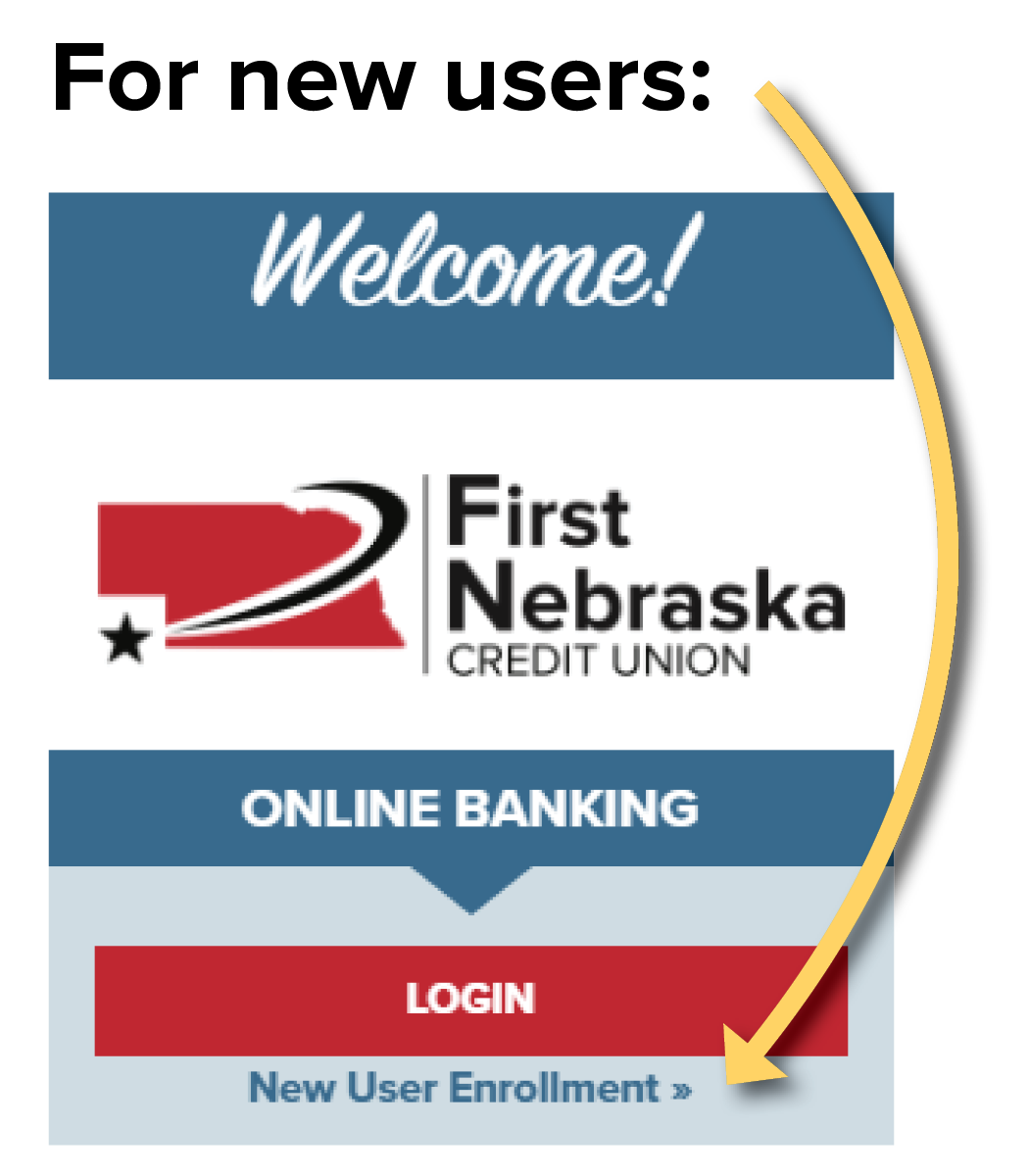

Need help enrolling in our Online/Mobile Banking? First-time users, you must “Enroll” before you can get into Online Banking or our Mobile Banking app. Enroll in one and have access to both! (They use the same login credentials!)

Click here to get additional help logging in to Online/Mobile Banking.

Get our FNCU app on your Apple and Android device.

On your mobile phone or tablet, download our FREE1 Mobile Banking app.

- 1. Type in “First Nebraska” or “FNCU” to find us.

- 2. After downloading the app, you’ll see the new FNCU icon on your screen.

- 3. Open the app and log in using the same user ID and password as Online Banking. Or if you haven’t signed up on Online Banking yet, click “enroll” to setup your login credentials. If your device supports it, you can enable Touch ID or Face ID login after enrolling.

1 Text, data and other wireless carrier charges may apply.

Logging In

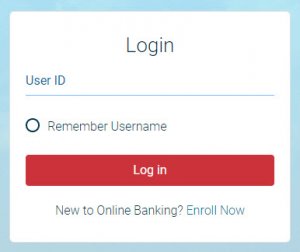

Only enter the user ID on the first screen.

If you click on “Remember Username”, you will not need to enter it again when you use the same device and browser within a 3-week period of time.

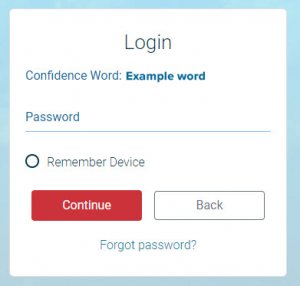

The confidence word that you set during enrollment will now be displayed. It is to help confirm your identity.

If you click on “Remember Device”, you will not need to enter the security questions when you use the same device and browser within a 3-week period of time.

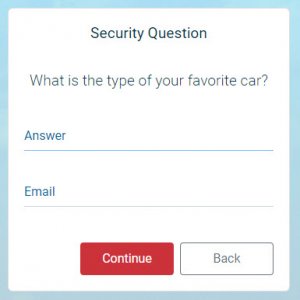

You will have to answer your security question even if you have previously selected “remember account.”

If you’re opening an account or applying for a loan, see what documents you’ll need to get started.

New Member/Savings Account

- Valid driver’s license or government issued photo ID

Note: If current driver’s license or government-issued ID does not match current address. One of the following is also required:

-

- Utility or telephone bill

- Bank statement

- Vehicle or voter registration

Checking

- Valid driver’s license or government issued photo ID

Note: To open a checking account, you must have a share savings account which requires a minimum balance of $5.

Auto Loan

- Payoff statement (if paying off loan with another financial)

- Purchase Agreement or Bill of Sale (if purchasing a new or used vehicle)

- Valid driver’s license or government issued photo ID

- Current vehicle insurance information

- Proof of Income (most recent paystub(s) – within the last 30 days); or if Self-Employed you may need to provide your last 2-years of Federal Tax Returns (including all schedules) and an unaudited current YTD Profit & Loss Statement, along with two Business Bank Account Statements for the final 2 months on the current YTD Profit & Loss Statement.

If you are not currently a member, please also bring:

- Proof of current address. If current driver’s license or government-issued ID does not match current address. One of the following is also required:

- Utility or telephone bill

- Bank statement

- Vehicle or voter registration

Home Loan

- Proof of Income (1 months’ worth of current paystubs within the last 30 days); or if Self-Employed you may need to provide your last 2-years of Federal Tax Returns (including all schedules) and an unaudited current YTD Profit & Loss Statement, along with two Business Bank Account Statements for the final 2 months on the current YTD Profit & Loss Statement.

- Prior year’s W2(s) for all borrowers

- Valid driver’s license or government issued photo ID

- Proof of Homeowners Insurance

- Two months of financial statements, including all pages, for savings, checking, money market and CD accounts (1st Mortgage only).

- If buying a home, a copy of the purchase agreement signed by both buyers and sellers.

- Mortgage information – a statement for any mortgages currently against the property (if refinancing)

- An appraisal of your home may be required. If required, payment will be due prior to ordering the appraisal.

If you are not currently a member, please also bring:

- Proof of current address. If current driver’s license or government-issued ID does not match current address. One of the following is also required:

- Utility or telephone bill

- Bank statement

- Vehicle or voter registration

Home Equity

- Proof of Income (1 months’ worth of current paystubs within the last 30 days); or if Self-Employed you may need to provide your last 2-years of Federal Tax Returns (including all schedules) and an unaudited current YTD Profit & Loss Statement, along with two Business Bank Account Statements for the final 2 months on the current YTD Profit & Loss Statement.

- Prior year’s W2(s) for all borrowers

- Valid driver’s license or government issued photo ID

- Proof of Homeowners Insurance

- Mortgage information – a statement for any mortgages currently against the property.

- An appraisal of your home may be required. If required, payment will be due prior to ordering the appraisal.

If you are not currently a member, please also bring:

- Proof of current address. If current driver’s license or government-issued ID does not match current address. One of the following is also required:

- Utility or telephone bill

- Bank statement

- Vehicle or voter registration

Credit Card

- Proof of Income (most recent paystub(s) – within the last 30 days); or if Self-Employed you may need to provide your last 2-years of Federal Tax Returns (including all schedules) and an unaudited current YTD Profit & Loss Statement, along with two Business Bank Account Statements for the final 2 months on the current YTD Profit & Loss Statement.

- Valid driver’s license or government issued photo ID

If you are not currently a member, please bring:

- Proof of current address. If current driver’s license or government-issued ID does not match current address. One of the following is also required:

- Utility or telephone bill

- Bank statement

- Vehicle or voter registration

Youth Accounts

Children age 19 and under must be accompanied by an adult to open an account.

- The adult joint owner must bring a valid driver’s license or government issued photo ID.

- Proof of identity is required for the minor: Either a birth certificate or Social Security card.

eSigning

There’s no need to come into a branch to sign documents! Sign electronically for loans and when opening accounts. All you need is an email address. (Not available for mortgages, home equity loans, home equity lines of credit, or members ages 17 and under.)

Lost/stolen cards or suspicious activity.

Visa Debit and Credit Card

If your debit or credit card has been lost or stolen, or you have unauthorized transactions on your card, call FNCU at (866) 299-3350, during or after business hours.

For all other unauthorized transactions, call FNCU at (402) 492-9100 or (800) 882-0244, during business hours.

Suspicious Activity – Identity Theft

If you see suspicious activity on your account, become a victim of identity theft, or suspect you might be, for any reason, give us a call immediately:

During business hours, call 1-866-299-3350. Press 3 for debit cards, or press 4 for credit cards.

After hours, you may call 1-866-210-0361. Click here for information about our identity theft program.

How Can We Help?

Browse our frequently asked questions to get answers to your questions.