Fixed rate or variable rate?

What is best for you?

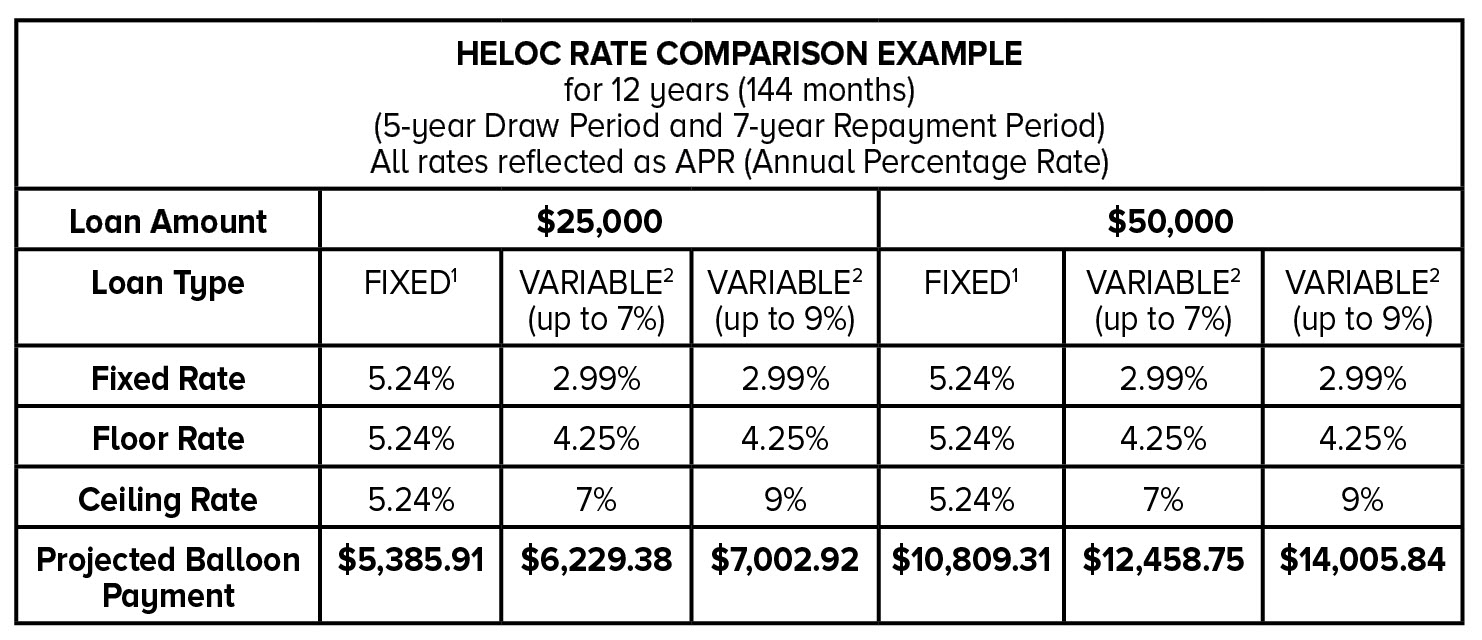

Low-rate advertisements catch our eye when we’re shopping for loans. When it comes to loan rates, 2.99% is better than 5.24%, right? That seems obvious. But that’s not always the case. The fine print matters. If the 2.99% rate is variable for one year, then it bumps up to 7%, is that better than a fixed 5.24% rate? The answer takes some calculating and knowing a bit about rates. (What is a “prime” rate, anyway?!)

Before you Google it or grab a calculator, let me tell you a secret.

We have the answers at our fingertips. Our loan specialists help people every day to figure out what the best offer will be. Each situation is different, so take a moment to stop in or give us a call, tell us what your goals are, and we’ll make sure you know all your options.

So, can a 5.24% rate end up being cheaper than a 2.99% rate? Yes, it can. Take a look at this Home Equity Line of Credit example, which gives two loan example amounts ($25,000 and $50,000), along with a fixed rate of 5.24% and two variable rate options starting at 2.99% and going up to 7% and 9% (we don’t know how much rates will rise in the future, but there is a good chance they will.*).

The last row shows that you could save approximately $1,000-$2,000 over the course of the 12 year loan.

However, we believe price isn’t everything – customer service, trust and good products also matter. But if we can help put money back in your pockets along with everything else, then we are following through on our mission of people helping people. It’s what we do.

So, if you are looking at rates – anything from auto loans, mortgage loans, or home equity loans, ask the experts first! We can quickly assess the situation, and we would love to save you money!

*Fed is expected to keep raising the federal funds rate to capture and hold the inflation rate near its target of 2%. And with the likelihood of rising inflation, accompanied by additional short-term interest rate increases by the Fed, mortgage rates are likely to keep rising.

1) Home Equity Lines of Credit (HELOC’s) are available for primary residences located in Nebraska or Pottawattamie County in Iowa. The fixed rate APR ranges from 5.24% to 9.50% depending on CLTV and credit score. Rates, terms and conditions are subject to change and may vary based on creditworthiness, qualifications and collateral conditions. All loans subject to approval. Applicants will be responsible for cost of appraisal, if required. The closing costs depend on the location of the property and the amount of the equity line. For Loan lines up to $100,000, closings costs typically range between $225 and $1,000. Payments based on 1.50% of outstanding balance at the end of statement cycle or $25 whichever is greater.

2) Variable rates quoted are for illustrative purposes only. Comparison based off historical example and current market conditions.