Crossing your fingers in hopes that identity theft won’t happen to you…isn’t a good idea.

Open a Checking Account1 at First Nebraska that includes identity theft protection at no additional cost.

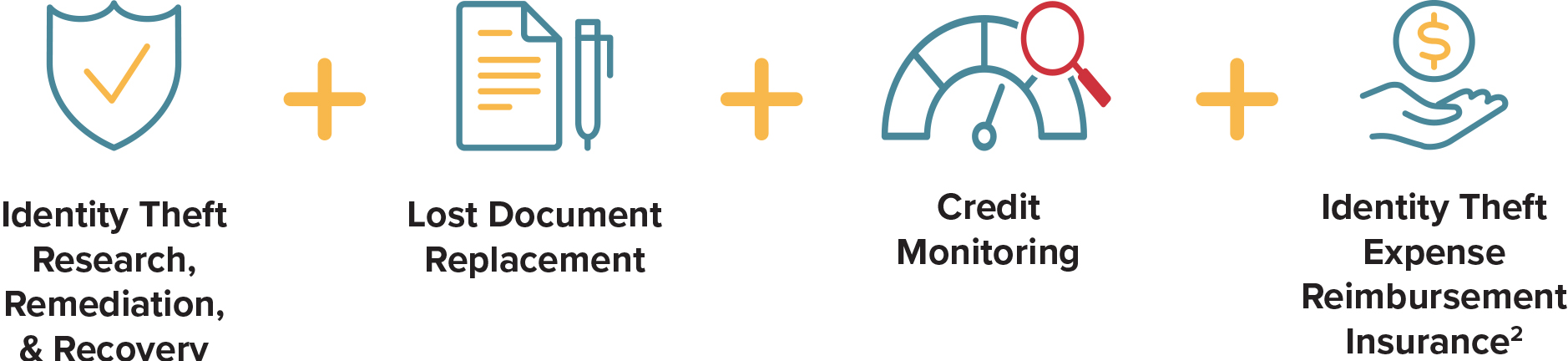

Identity Theft Solutions helps detect and recover from the consequences of identity theft.

When you activate our free credit monitoring, it will notify you of potential fraud.

To open a checking account, you must have a share savings account which requires a minimum balance of $5. To qualify for a checking account, you must meet certain eligibility requirements. Certain checking accounts have a monthly service fee or a minimum balance fee. Parent/guardian required for account holders under 18. For more information on our fees for checking, visit firstnebraska.org/checking. All checking products and services are subject to applicable member agreements, terms and conditions.

1 Premier, Secure, and Select Checking Accounts include Identity Theft Solutions; Classic checking does not. For more information, visit firstnebraska.org/identity-theft-solutions.

2 Identity theft insurance is underwritten by Lyndon Southern Insurance Company, a member of the Fortegra family of companies. The information provided is a program summary. Please refer to the Identity Theft Expense Reimbursement Evidence of Coverage forms for additional information including details of benefits, specific exclusions, terms, conditions and limitations of coverage. Coverage is currently not available in NY and may not be available in other U.S. territories or jurisdictions in the future.