International Credit Union Day

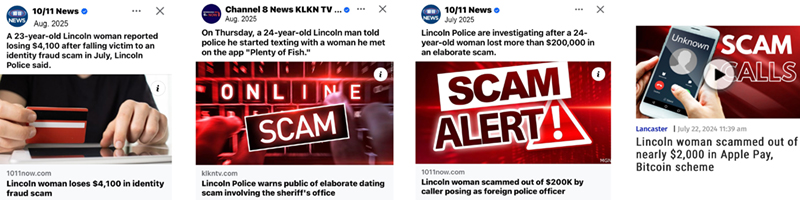

Recent Scams in Nebraska

The Nebraska Attorney General’s Office recently released a Consumer Alert Video series as part of their effort to assist Nebraska citizens from falling victim to devastating scams that rob them of their money and personal information.

The videos will spotlight recent scams across Nebraska and give insight into how to avoid and recover from them.

This article highlights the Overpayment Scam:

What is an Overpayment Scam?

An overpayment scam occurs when a scammer sends you a payment that exceeds the amount owed, often using a fake check, fraudulent credit card, or stolen account. Then they ask you to send back the difference—usually via wire transfer, gift cards, or a payment app—before the original payment is discovered to be invalid.

By the time the fraud is detected (which can take days or weeks), you’ve already sent real money to the scammer, and you’re left responsible for the entire loss

Common Scenarios:

1. Online Sales (Craigslist, Facebook Marketplace, eBay)

-

- Buyer “accidentally” sends too much and asks for a refund of the extra.

2. Job Offers or Mystery Shopping Gigs

-

- You’re paid upfront with instructions to send part of the money elsewhere.

3. Rental or Housing Scams

-

- A “tenant” or “renter” overpays and asks for part of it back before the check clears.

4. Romance or Inheritance Scams

-

- The scammer concocts a story involving overpayments or emergency refunds.

You can learn more, or report a scam, or learn more about scams at ProtectTheGoodLife.Nebraska.Gov. It includes excellent information about scams, online safety, identity theft and more. Or give them a call at 402-471-2682.

Here are a few of the YouTube videos the Nebraska AG Office has available:

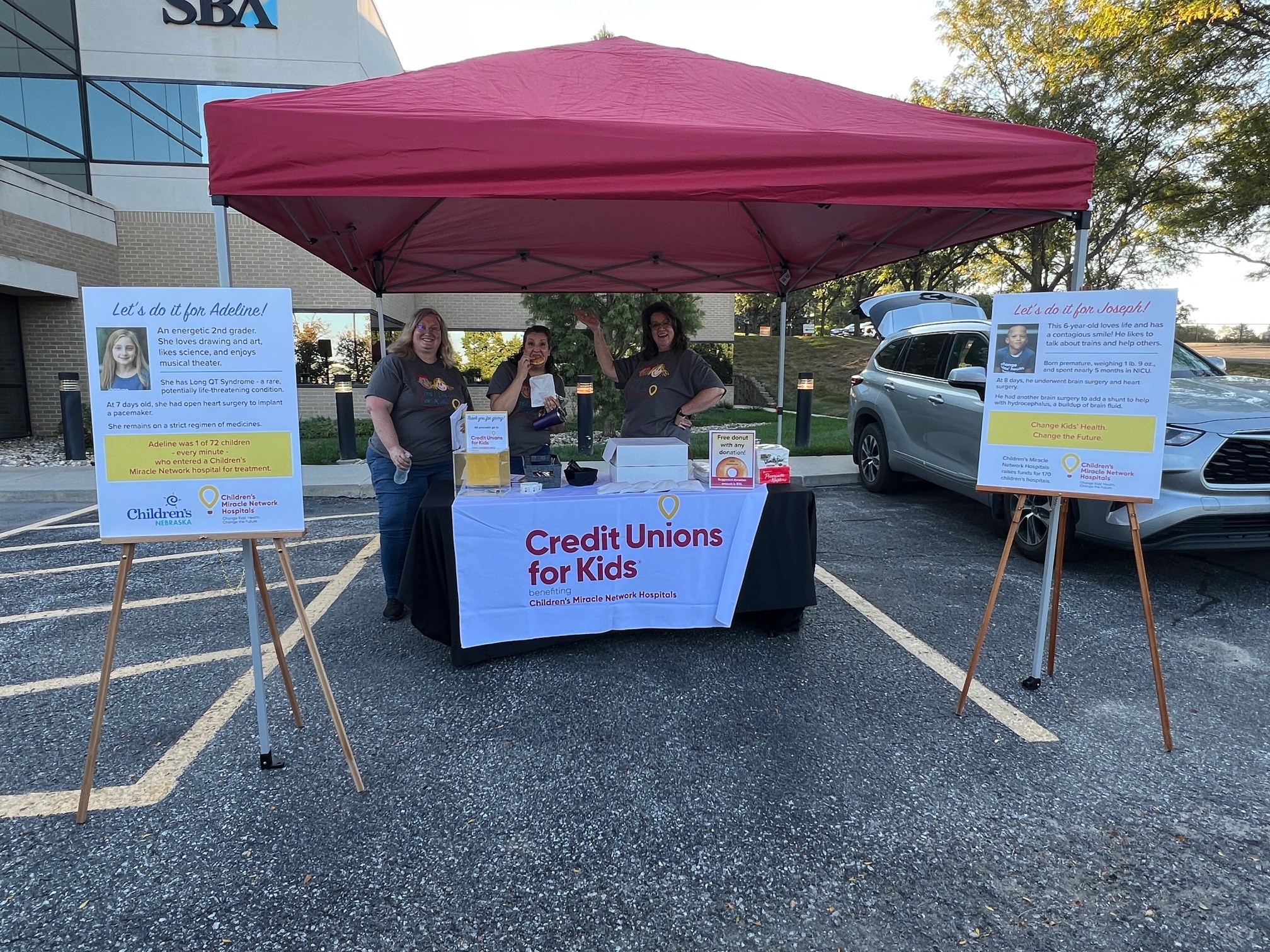

Shred Event Raises $637 for Children’s Nebraska

Thank you to everyone who joined us for our Shred Event and Donation Drive for Children’s Nebraska and Children’s Miracle Network Hospitals in September! Together, we raised $637 to donate to the hospital in Omaha! Your support helps provide life-changing care to children and families right here in our community. We’re so grateful for your generosity and participation!

Get your Credit Score!

Do you have a Premier, Secure, or Select Checking Account? If so, you now have access to your credit score.

These new, free features started in August:

- ENHANCED! Credit File Monitoring:1 daily credit file monitoring and automated alerts of key changes to your credit report. Credit file monitoring will be turned on automatically for the primary account owner, provided information has been verified by the Credit Reporting Agency.

Must be 18 years or older. Additional Terms and Conditions apply. - NEW! Credit Score and Credit Score Tracker:1 access to request your credit score, and receive valuable insight into your credit score

Plus the great features you’re used to:

- Fully Managed Identity Theft Resolution Services: access to a dedicated fraud specialist assigned to manage your case until your identity is restored.

- Up to $25,000 Identity Theft Expense Reimbursement Coverage: for expenses associated with restoring your identity.

Members eligible for these enhanced benefits will need to take a few quick steps to fully register and access them. Please refer to the letter you received in the mail (in July) or the email (in September) for step-by-step instructions on how to register and access the benefits through the new benefits site.

1) Registration/activation required. Terms and conditions apply.

Lost or Stolen Card?

If your debit or credit card has been lost or stolen, or you have unauthorized transactions on your card, call FNCU at (866) 299-3350, during or after business hours.

For all other unauthorized transactions, call FNCU at (402) 492-9100 or (800) 882-0244, during business hours.

48th ITM Winners

These Members won $100 gift card in July for using our ITM!

- Jeannene P.

- JoAnn G.

- Vicki H.

- Kristi H.

Employee Recognition

Congratulations to these employees on their promotion!

July-August 2025

Amber P. was promoted to Vice President of Operations.

Ken S. was promoted to Vice President of Sales & Service.

Stephanie M. was promoted to Vice President of Human Resources.

Steve T. was promoted to Vice President of Lending.

Yesi R. was promoted to Collection Manager.

To learn more about our leadership team, visit our Recognitions page.

Anniversaries

Sept. 2025

Happy 5-year Anniversary, Ken S.! Ken has been with FNCU for 5 years. During that time Ken has taken on various leadership roles within the credit union. Congrats, Ken!

What our members are saying

“I am genuinely excited about the service I’ve received at this credit union.” – Shela J.

Closed for the Holidays

Columbus Day/Indigenous People’s Day

Monday, Oct. 13

Veterans Day

Tuesday, Nov. 11

Thanksgiving Holiday:

Thursday, Nov. 27 – Closed

Friday & Sat., Nov. 28–29 – Lobbies closed

Friday, Nov. 28 – Drive-thrus OPEN

Sat., Nov. 29 – Drive-thrus OPEN (except 48th St.)

Christmas Holiday:

Wednesday, Dec. 24 – Lobbies closed

(Drive-thrus OPEN 9 am–12:30 pm)

Thursday , Dec. 25 – Closed