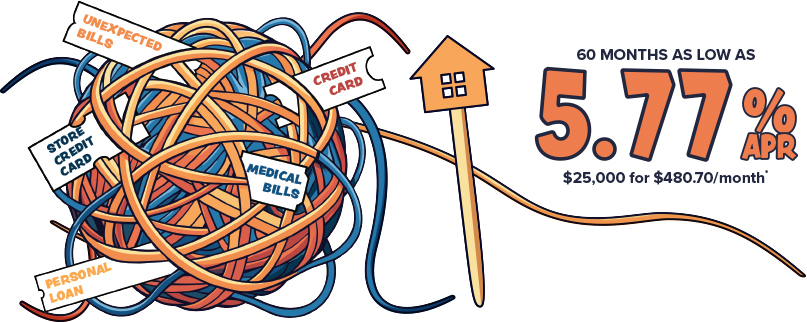

…with the Power of your Home Sweet Home-Equity!

Turn that twisted tangle into financial peace of mind.

A loan can help you roll your debts into one simple payment—with a lower interest rate, a lower monthly payment – or both!1

Get a Home Equity Loan!

60 MOS. AS LOW AS 5.77% APR*

As a homeowner, you may have equity in your home that you can borrow from.

Don’t own your home?

Ask us about using the equity in your car or getting a personal loan.

APR = Annual Percentage Rate. Rates, terms and conditions subject to change and may vary based on creditworthiness and qualifications. All loans subject to approval.

1) It is not guaranteed that consolidating multiple debts into a single monthly payment will result in a lower monthly payment or lower interest rate. Payment reduction may come from a lower interest amount, a longer-term loan, or a combination of both.

*Home Equity/2nd Mortgage: Rates effective as of 10/25/2025. Rate offered for secured, new money loans only, for terms of 60 months. Collateral insurance required. Payment example: For a $25,000 dwelling secured loan for a term of 60 months at 5.77% APR, the monthly payment will be $480.70. Debt protection is available. Applicants will be responsible for cost of appraisal if required. Available for residences located in Nebraska and Pottawattamie County in Iowa. All payments calculated with loan-to-value of 80%. The actual amount of your loan will be determined by the amount of equity in collateral. Rates are higher for LTV over 80% or terms greater than 60 months. Terms up to 180 available. Must have FNCU checking account with direct deposit and automatic loan payment. Members without a checking account, direct deposit and automatic loan payment may receive a slightly higher rate (.25%). Credit qualifications and other restrictions may apply. Actual rate and monthly payment amount may vary. Payment examples do not include amounts for taxes and insurance premiums, if applicable, the actual payment obligation will be greater.